Home title theft: An overview plus protection tips

Is home title theft real? It’s definitely a growing concern related to identity theft. Learn more and consider these home title protection tips.

As the saying goes, East, West, home's the best. And it couldn’t be truer for cybercriminals committing home title theft.

This all-too-real reality of someone stealing your home right under your nose has become an increasing threat in recent years, with the FBI fielding reports from coast to coast. Consider a Virginia woman discovering through a piece of junk mail that a total stranger had purchased her home, and even real estate investors being the perpetrators of deed theft.

We’ll address just what is home title theft and how it occurs, statistics to consider, and pointers to help you keep your house in order — please do try these at home!

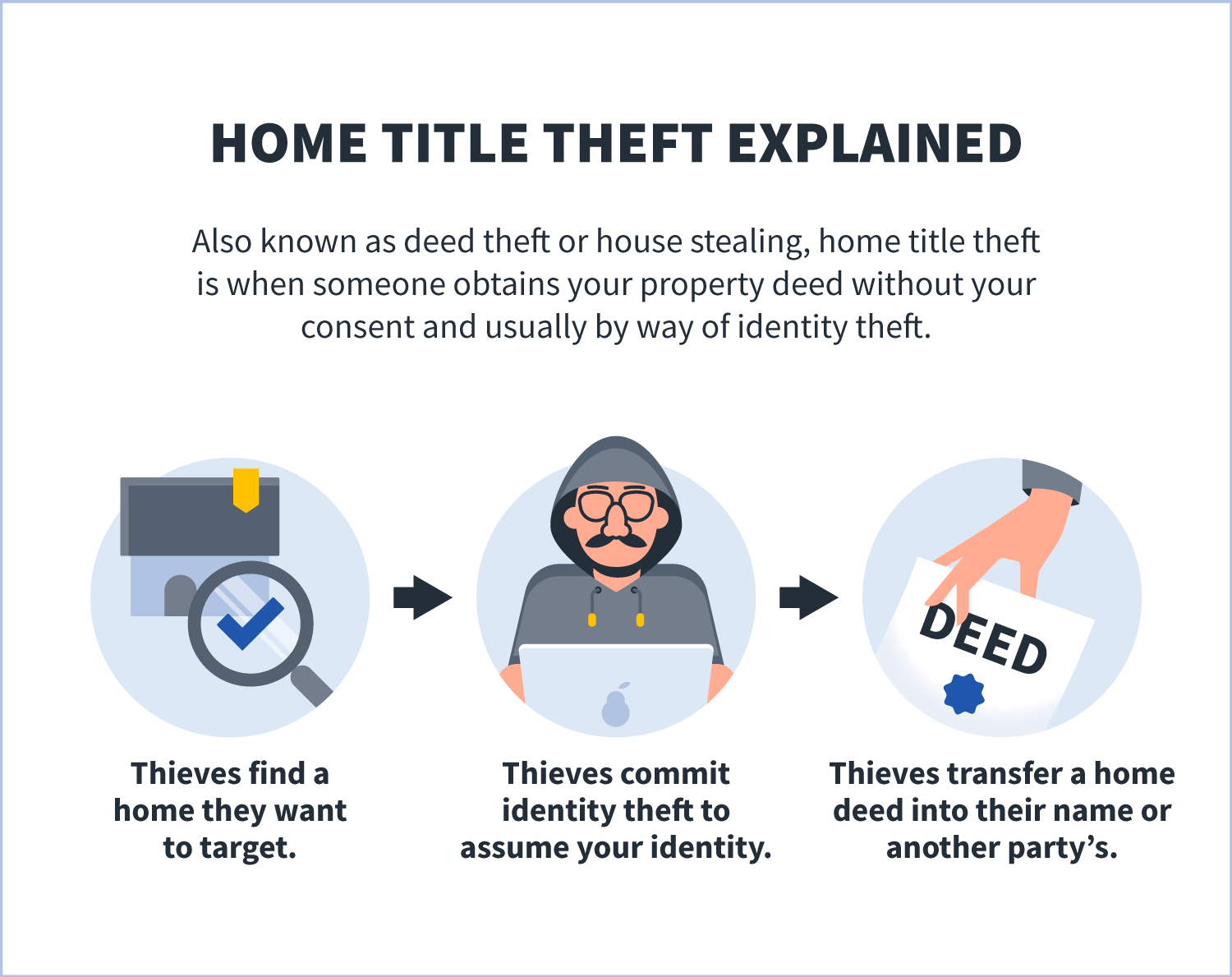

What is home title theft?

Home title theft, also known as deed theft, is when someone obtains your property deed without your consent usually by way of identity theft. It’s the act of fraudulently transferring a home deed out of your name and into another person’s. It’s also sometimes referred to as home title fraud.

In 2008, the FBI first reported on the scheme, coining it house stealing. The Bureau describes it as a cybercrime cocktail of sorts, being a mix of identity theft and mortgage fraud — but don’t confuse it with this. Mortgage fraud happens before a home is purchased and is the act of providing fraudulent information to obtain a mortgage.

Home title theft can generally be summed up in three steps:

- Thieves find a home they want to target, oftentimes a vacant or vacation property.

- Thieves commit identity theft to assume your identity, creating supporting documentation like fake ID, Social Security card, and other personal identifiers.

- Thieves work through lawful authorities to transfer a home deed by forging your signature and using fraudulent documents.

Is home title theft a big problem?

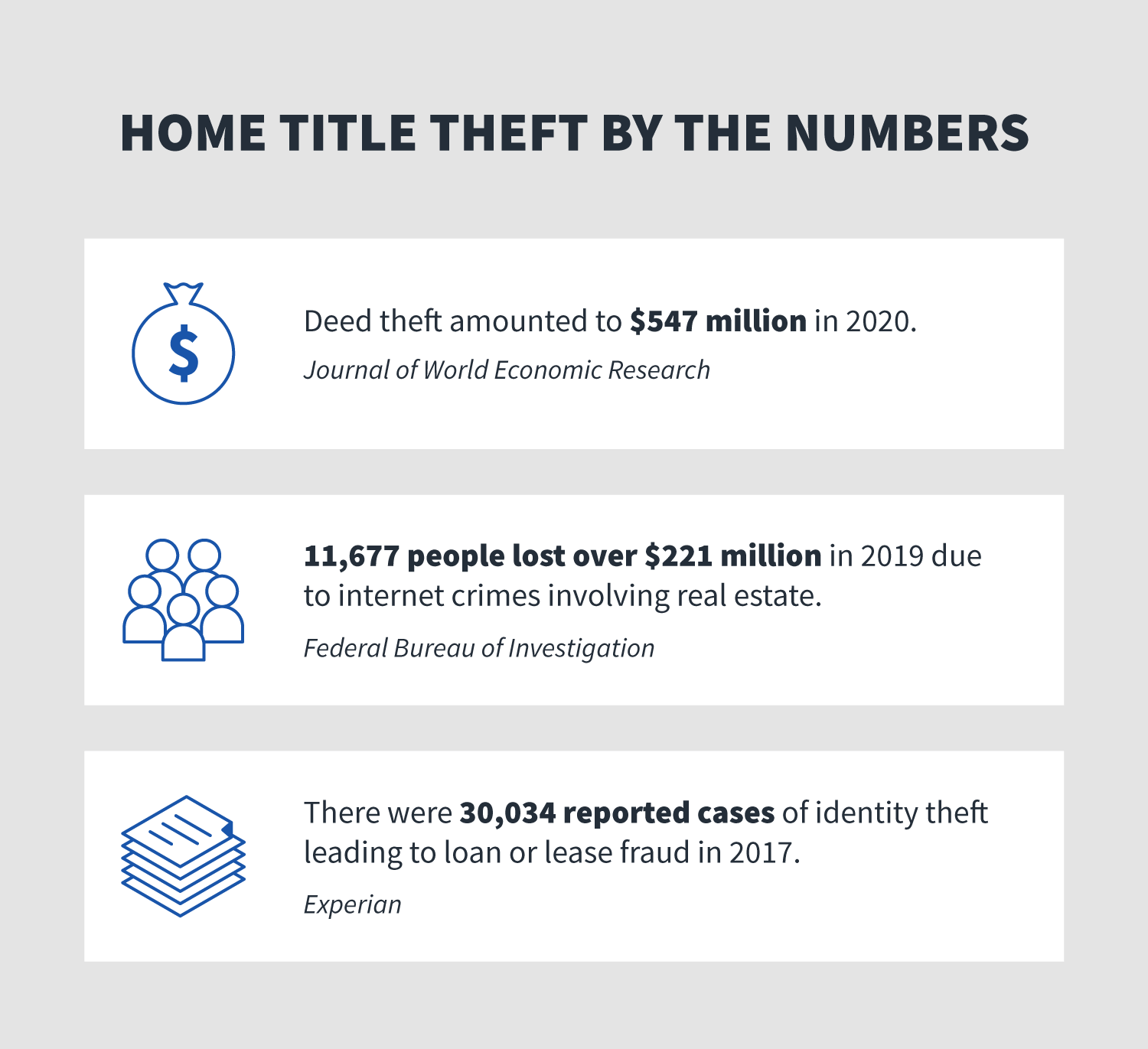

Home title theft has become a growing concern in the cybersecurity business, with FBI reports and other data supporting that.

According to the Journal of World Economic Research, deed theft amounted to $547 million in 2020.

While the FBI hasn’t collected specific data on home title theft, the crime falls under identity theft — the FTC reports this as the largest threat consumers face — and that can be considered an internet crime.

According to the FBI’s 2019 Internet Crime Report, the bureau received 467,361 complaints of internet crime, with reported losses exceeding $3.5 billion. Narrowing those crimes down to those involving real estate, and the FBI reported 11,677 people lost more than $221 million in 2019. That’s significantly more than in 2017, when the FBI reported over 9,600 people lost a total of $56 million in internet crime involving real estate.

In this same year, according to Experiean’s Identity Theft Statistics report, there were also 30,034 reported cases of identity theft leading to loan or lease fraud.

For those who are victims of home title theft, it can be a big problem. If a thief succeeds in securing your deed, they may:

- open a home equity line of credit in your name

- attempt to sell your home

- refinance your mortgage and cash out the equity, leaving you facing foreclosure

- force you to incur legal fees to clear the title

How is a deed stolen?

Home title theft often involves cybercriminals committing identity theft.

This can occur in several ways. The following are some of the most common routes to home title theft.

Phishing

Phishing is when cybercriminals send fraudulent emails or texts that look legitimate. These messages might contain links causing you to download malware capable of mining your computer for personal information that can help them steal your identity. They also might simply ask you for sensitive information outright under the guise of a trusted source.

- Tip: Never open suspicious-looking emails, click on links, or download material in them.

Phone scams

Phone scams could be considered an extension of senior scams, because criminals often target less tech-savvy populations. How does it work? Fraudsters call you on the phone claiming to be from a bank or the IRS asking for account details or money. In fact, banks and the IRS only communicate through the mail.

- Tip: Don’t provide sensitive information over the phone and hang up immediately when it’s requested.

Hacking public Wi-Fi

Hackers love public Wi-Fi, and that’s because public networks are often unencrypted, giving cybercriminals a chance to snoop on data traveling to and from your device and even inject malware to gain access to your data.

- Tip: Consider the added precaution of using a VPN to connect to public Wi-Fi.

Dumpster diving

Yes, identity thieves can be old-fashioned sometimes and may merely sift through your trash to patch together personal information like bank account numbers, health insurance cards, or credit card details to commit identity theft.

- Tip: Shred mail before discarding it, especially documents that contain credit card numbers, tax-related information, or other personal details.

Mail theft

Similar to dumpster diving, mail theft is when thieves go straight to the source potentially holding your sensitive information: your mailbox. They sift through it in hopes of finding personal information such as a credit card statement with your account number or a tax form with your Social Security number.

- Tip: Promptly pickup mail, request signature confirmation, inquire about overdue mail, and follow USPS mail protection pointers.

What to do if your home title is stolen

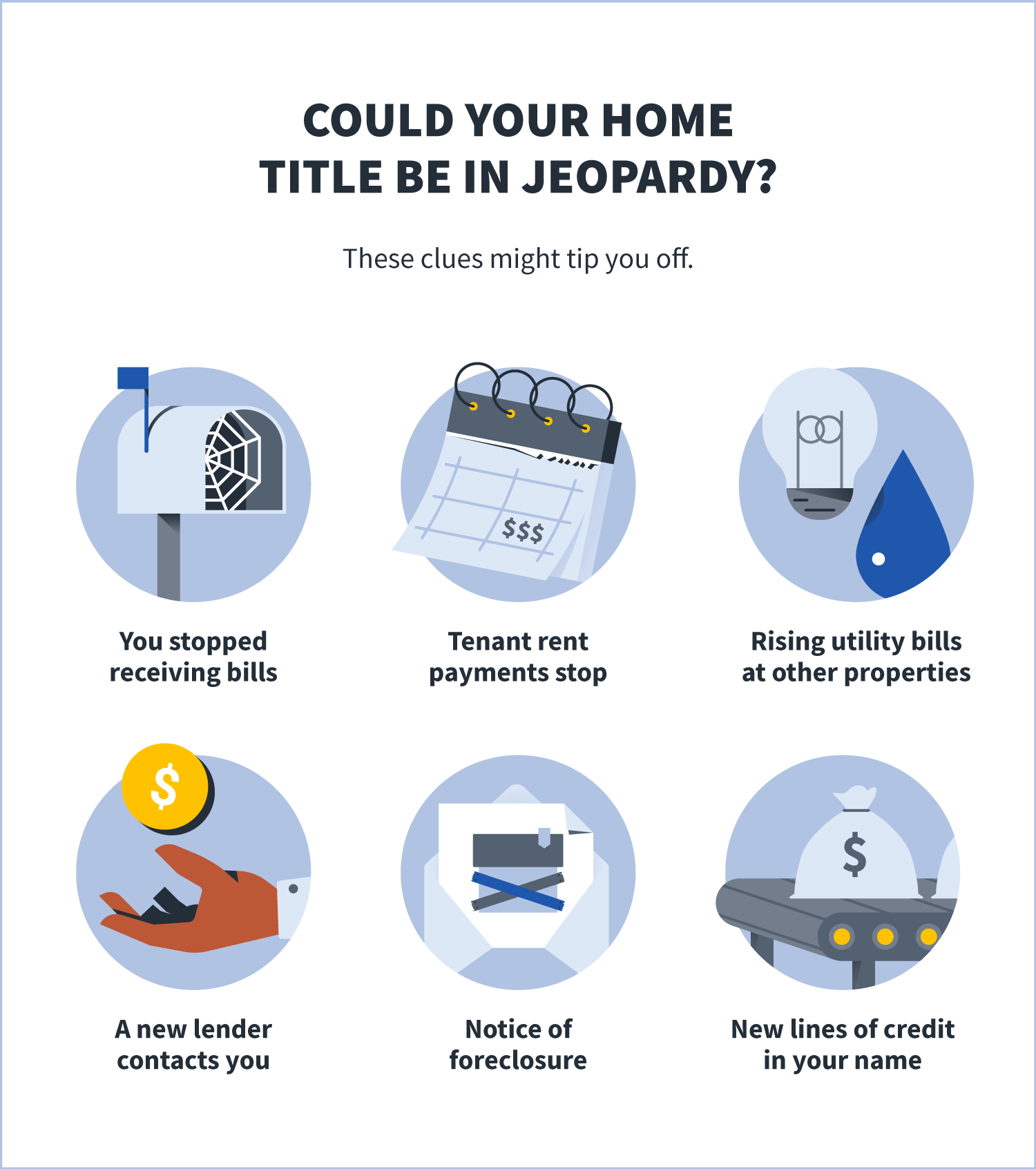

Would you know the signs of your home title being in jeopardy? A few things can tip you off. You just need to know what clues to look for, including some signs of identity theft. You may be a victim of home title theft if, you’ve:

- stopped receiving bills

- seen rising utility bills at vacant or second properties

- stopped receiving tenant rent payments

- received information from a lender you’ve never done business with

- received notifications of foreclosure

- been notified of suspicious loans or new lines of credit in your name

If you’re suspicious, act fast and follow FTC guidance:

- Contact the companies where you’ve identified an instance of fraud occurred.

- Place a fraud alert with credit bureaus and get your credit reports.

- Report identity theft to the FTC.

- File a report with your local police department.

10 tips to help protect yourself from home title theft

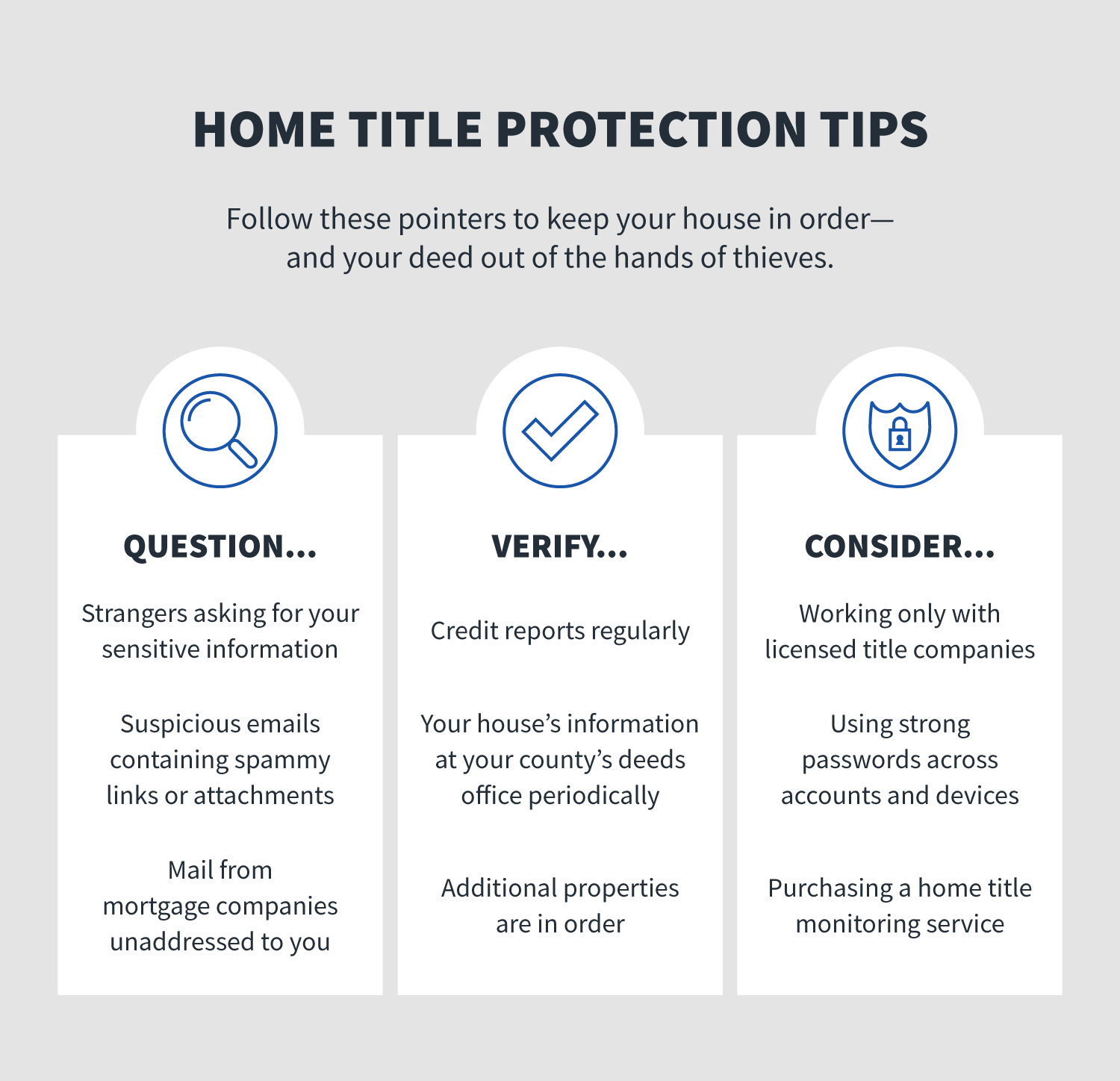

Victims of home title theft have no choice but to be reactive, but all homeowners can be proactive in protecting themselves from home title fraud.

For starters, that’s recognizing that criminals like easy targets. Make sure you’re not one. Keep your house in order with the following home title theft pointers.

Be wary of suspicious activity

Simply being cautious of what comes through your mailbox and on your bank statements can go a long way in halting home title theft.

- Do open mail from mortgage companies that aren’t yours, especially if the mail is addressed to someone else.

- Don’t open suspicious emails. They could be phishing attempts as part of identity theft.

- Consider why and if someone really needs your signature or other sensitive information when they ask for it.

Regularly monitor your documents and property

Sure, your second house may not be your “home,” but it’s likely more susceptible to home title fraud. This is because fraudsters realize vacation or second-home properties aren’t watched as closely. Don’t ignore the important stuff like these second-home properties, credit reports, and other records.

- Regularly review your credit reports.

- Periodically verify your house’s information at your local county recorder or assessor’s office.

- Physically monitor additional properties or have a trusted source do so regularly.

Evaluate yours and others’ security practices

Weak passwords can be easy for cybercriminals to crack. Doubling down on your cybersecurity and your home title monitoring is a smart way to help ward off criminals.

- Use strong passwords and never the same on across devices.

- Consider a title monitoring service, which notifies you of activity regarding your home title at the recorder’s office.

- When purchasing a property, double check that a title company is licensed.

- If applicable, register for your county’s consumer notification service, which signs you up for alerts any time a document is recorded on your property.

Indeed, East, West, home's the best. Stay vigilant about protecting yours from home title theft by following these pointers and also being aware of signs of identity theft.

LifeLock Home Title Protect helps protect your most valuable asset, your home.

We help detect fraud by notifying you if we find changes made to home title. If you become a victim of identity theft, we’ll provide a dedicated, Identity Restoration Specialist to work with until your case is closed.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.